Tax Compliance with HRIS: What You Need to Know

Tax compliance with HRIS will surely lessen your burden during tax season by streamlining your processes. Read to know how!

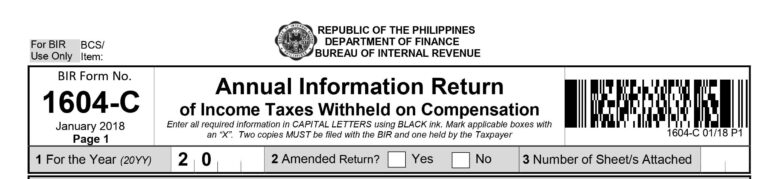

Most people would suddenly get all cheerful when December finally comes around the corner. Unfortunately, it’s usually quite the opposite for accountants and admin personnel as it’s time to deal with year-end tax preparations, such us BIR Form 1604-C.

Most likely, this is your first time to get across this year-end tax information return. If so, let’s get you familiar with this form real quick by getting the answers to the frequently asked questions.

BIR Form 1604-C is the Annual Information Return of Income Taxes Withheld on Compensation. Employers in the Philippines file this ‘annual report’ to officially declare the amount of taxes they have withheld from employees’ compensation throughout the calendar year.

Employers or withholding agents/payor. The Bureau of Internal Revenue (BIR) identified these as: “an individual, estate, trust, partnership, corporation, government agency and instrumentality, government-owned and controlled corporation, local government unit and other juridical entity required to deduct and withhold taxes on compensation paid to employees.”

To fully understand the role of a Withholding Agent in this aspect, please read our article BIR Withholding Taxes on Compensation: (An Overview).

Let’s say that your information return covers the calendar year January 2022 to December 2022. You must file the information return for this period on or before January 31 of the following year—in 2023 to be exact.

The latter is actually the monthly remittance return on income taxes withheld from employees’ compensation. The information provided by the January to December returns should be accurately summed up in BIR Form 1604-C.

The letter ‘C’ in BIR Form 1604-C means ‘compensation’ — the payments received by an individual as a result of an employer-employee relationship.

Under Philippine laws, employers are mandated to act as ‘Withholding Agents’. In this regard, they must compute, deduct, and temporarily keep the taxes due from the compensation being received by their employees.

All three forms deal with withholding taxes, but of different classifications. As stated previously, the letter ‘C’ is for withholding taxes on ‘compensation’, so that form is exclusively about the tax withheld from the compensation received by employees.

For the other two forms, the letter ‘E’ is for ‘expanded withholding tax’, while ‘F’ is for ‘final withholding tax. To know more about the classification of withholding tax, kindly refer to the tax information page on the BIR website.

This is the old form that was later split into BIR Form 1604-C and BIR Form 1604-F in view of the Tax Reform for Acceleration and Inclusion (TRAIN) Law, which took effect on January 1, 2018.

Now, let’s get acquainted with the form attachments commonly referred to as the BIR Alphalists.

The “Alphabetical List of Employees/Payees from Whom Taxes Were Withheld” are the required attachments for your annual information return. The Alphalists are provided in two sets: one is exclusively for your Minimum Wage Earners (MWEs), and one is for your Non-MWES.

These lists essentially break down into detail the information you have provided in BIR Form-1604-C. Through these Alphalists, the government can pinpoint from whom you have withheld compensation taxes from, and by how much. Additionally, the BIR will also know the total compensation that your business has paid to each employee in a given year, and even break it down to its taxable and non-taxable components.

First, these lists require details about your employees, such as their complete names, tax identification number (TIN), employment status and related info. Second, you must summarize the information from your monthly payroll runs

This is because MWEs enjoy more tax breaks on their compensation compared with their non-MWE counterparts. Aside from the wages they receive, they also enjoy tax exemptions on their

Holiday Pay, Overtime Pay, Night Differential Pay, and Hazard Pay.

Fulfill your responsibilities to the BIR with minimum effort using Hurey, the Philippines’ leading HRIS! We’ve harnessed the full power of digital technology to deliver effective solutions that thousands of business owners, HR professionals, and accounting personnel now can’t simply live without.

As an example, did you know that your business can automatically generate withholding tax reports that are related to employee compensation? Yes, this is indeed possible with Hurey!

Say goodbye to manual encoding of data and calculation of withholding taxes! Get Hurey, complete the initial system setup, and implement your automated payroll runs. Once this has been achieved, our cloud-driven app churns out accurate tax calculations based on your monthly payment runs. The resulting data are intelligently processed by Hurey, which it uses to completely fill out the following BIR forms for you: 2316, 1601-C, and finally, 1604-C and the attached Alphalist of Employees.

Just think of the hundreds of precious manhours that you can save on the aspect of tax filing preparations alone. Discover the full range of benefits that Hurey can bring to your business by booking your free demo now!

What are you waiting for?

Share us on

Tax compliance with HRIS will surely lessen your burden during tax season by streamlining your processes. Read to know how!

Read along as we explore HRIS security best practices, aimed at ensuring the utmost protection of employee data.

A revolutionary school management system for Filipino learners can help in improving education in the Philippines. Find out how!

The most scalable HR and Payroll app in the Philippines

Pages