Tax Compliance with HRIS: What You Need to Know

Tax compliance with HRIS will surely lessen your burden during tax season by streamlining your processes. Read to know how!

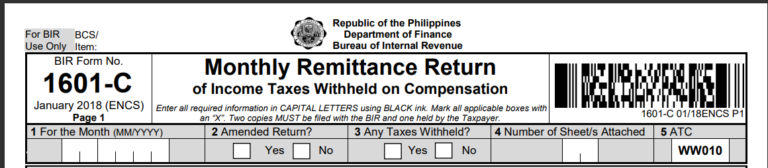

Establishing a payroll system can easily become a daunting task, especially if you’re a new entrepreneur who has little or no background in accounting. Our suggestion? Start with looking at BIR Form 1601-C because:

In any case, a clear understanding of BIR Form 1601-C will give you a general idea of what you should look out for in a payroll system.

Generally, you have three options as to how to proceed with your payroll. You can:

Did you know that businesses in the Philippines are obligated by law to act as Withholding Agents for the BIR? In fact, costly penalties and even jail time can result if a business is negligent in this aspect.

In a nutshell, what is BIR Form 1601-C?

BIR Form 1601-C should be filed by the tenth day of the next month. However, an exemption is set for the December report — its deadline is set on the 25th day of January on the following year.

Briefly, let us scan the sections of this form to get familiar with its structure and the specific sets of data it requires.

The topmost portion of BIR Form 1601-C asks you to indicate:

The heading covers Items 1-5.

Here’s where you’ll input the company’s name, address, contact details, tax identification number (TIN), and other business info. Covers Items 6-13.

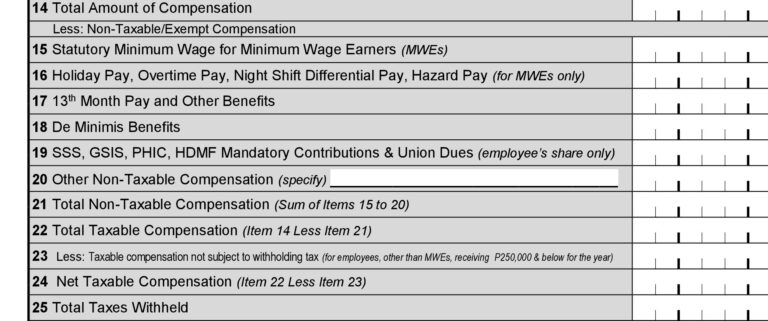

The core of BIR Form 1601-C. In this section, you’re essentially making a summary of your firm’s payroll. Moreover, the data you’ll provide will show how you’ve arrived at the total withholding tax figure. Includes Items 14-36.

How did you remit the taxes you’ve withheld to the BIR? Provide the related information in Items 37-40.

Withholding tax corrections from the previous months are indicated here, if there are any.

Now that we have a general overview of this BIR form, let us dissect its Part II to reveal key takeaways to guide your payroll computation.

Our key takeaways:

The people behind Hurey knows exactly what lies ahead of you. We’ve been there and done that.

Building your own payroll system is indeed possible, if you’ve got a lot of time and personnel to allocate for the project.

But soon, you’ll be looking for more features to eliminate the recurring, manual tasks needed to maintain your system. Also, you’ll find out that a spreadsheet-based payroll system has a lot of risks — e.g., files can be easily corrupted, deleted, or accidentally altered.

This was the reason why the Hurey HRIS was born. We knew the exact HR and payroll-related needs of businesses, from small startups to large conglomerates.

Everything that you will need, we’ve already done for you. By harnessing the power of digital technology, we’ve produced efficient solutions that are loved by hundreds of busy business owners and their HR and accounting personnel.

So why build everything from scratch when a complete, cost-effective, and ready-to-use HRIS is readily available for your organization?

Don’t waste your time and get your new business running ASAP! Book a free Hurey demo now!

What are you waiting for?

Share us on

Tax compliance with HRIS will surely lessen your burden during tax season by streamlining your processes. Read to know how!

Read along as we explore HRIS security best practices, aimed at ensuring the utmost protection of employee data.

A revolutionary school management system for Filipino learners can help in improving education in the Philippines. Find out how!

The most scalable HR and Payroll app in the Philippines

Pages